You, our BRICKX community are an amazing bunch of people. Not only are you part of our revolutionary way through Bricks, to access the investment potential of what many view as an inaccessible Australian property market, but your regular and honest feedback is helping us shape our product.

We had more than 1,000 responses to our recent survey, and as you have come to expect from BRICKX and our transparent approach, we wanted to share our findings, our respondents’ thoughts, feedback, compliments and concerns with the entire community. More importantly, we’re also going to tell you how we’re using this feedback to try and make BRICKX even better!

Properties – what and where

Our ambition is to provide a large and diverse property investment offering to all our customers, from which they are able to access the locations and types of properties that meet their own investment strategies. This may involve investing in Bricks in properties Australia wide, or focusing on an individual capital city. We are also working on bringing a wider range of options with properties which have debt as well as those which have the potential for more attractive rental income. As we grow the offering, we’ll consider the feedback we have received and guidance and advice of the BRICKX property team in finding what we believe are the right opportunities for BRICKX.

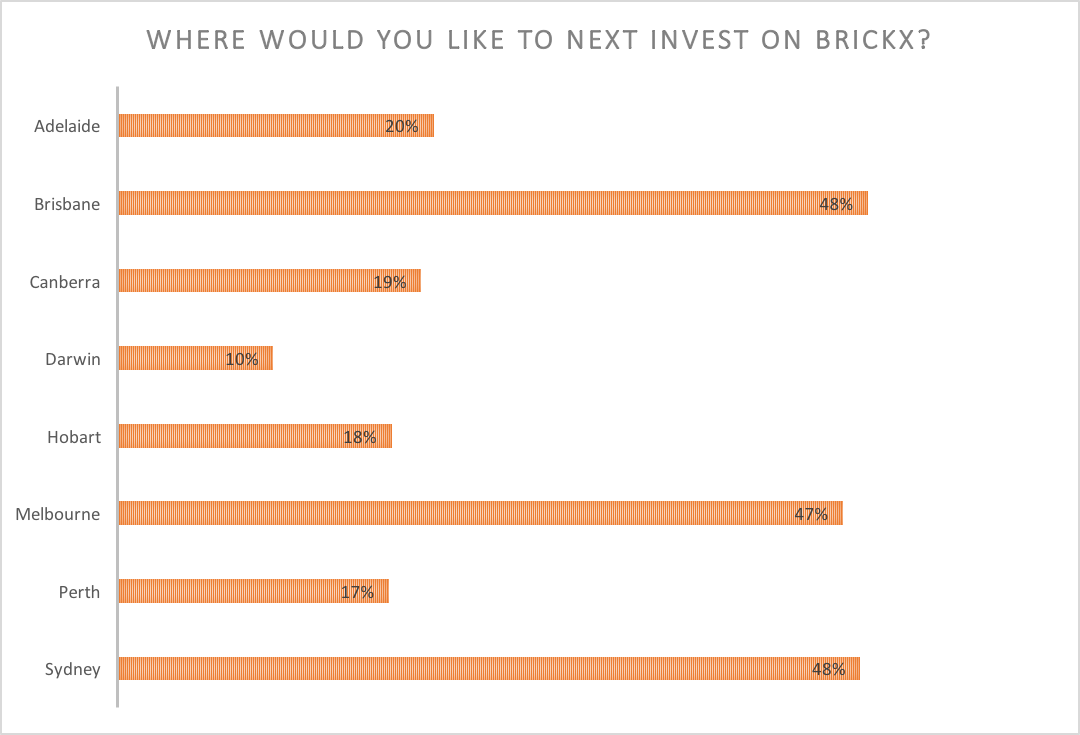

Where

Our survey has shown that our community is eager to next invest using BRICKX in the capital cities of Sydney, Melbourne and Brisbane. We currently have 7 properties across Sydney and Melbourne in which Bricks are available. (Note more than one option was selectable).

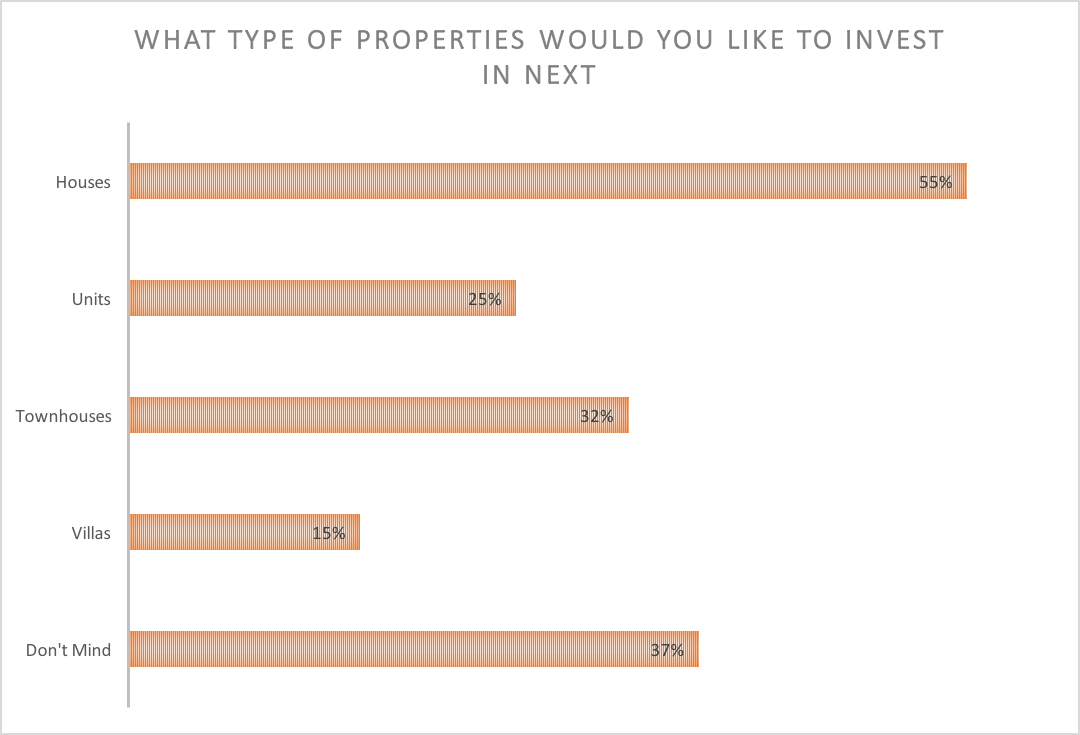

Type

When we asked what types of investments appealled to our community, you showed a preference for investing in houses (55%), however 37% preferred not to select an individual option and stated they didn’t mind. (Note more than one option was selectable).

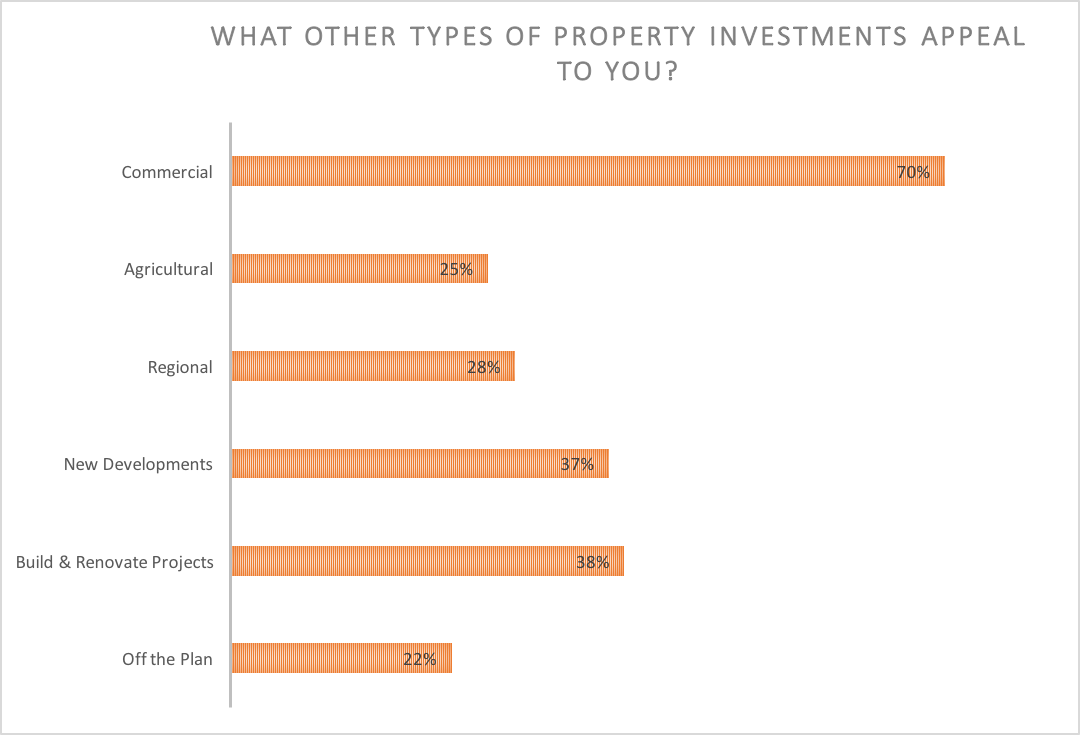

Expansion

Whilst BRICKX is currently focusing on purchasing quality residential property, in the future we would like to expand BRICKX to other types of property investments. Our survey has shown us that 70% of our community would be interested in commercial options, with 38% liking the idea of a renovation project, and 37% interested in new developments. (Note more than one option was selectable).

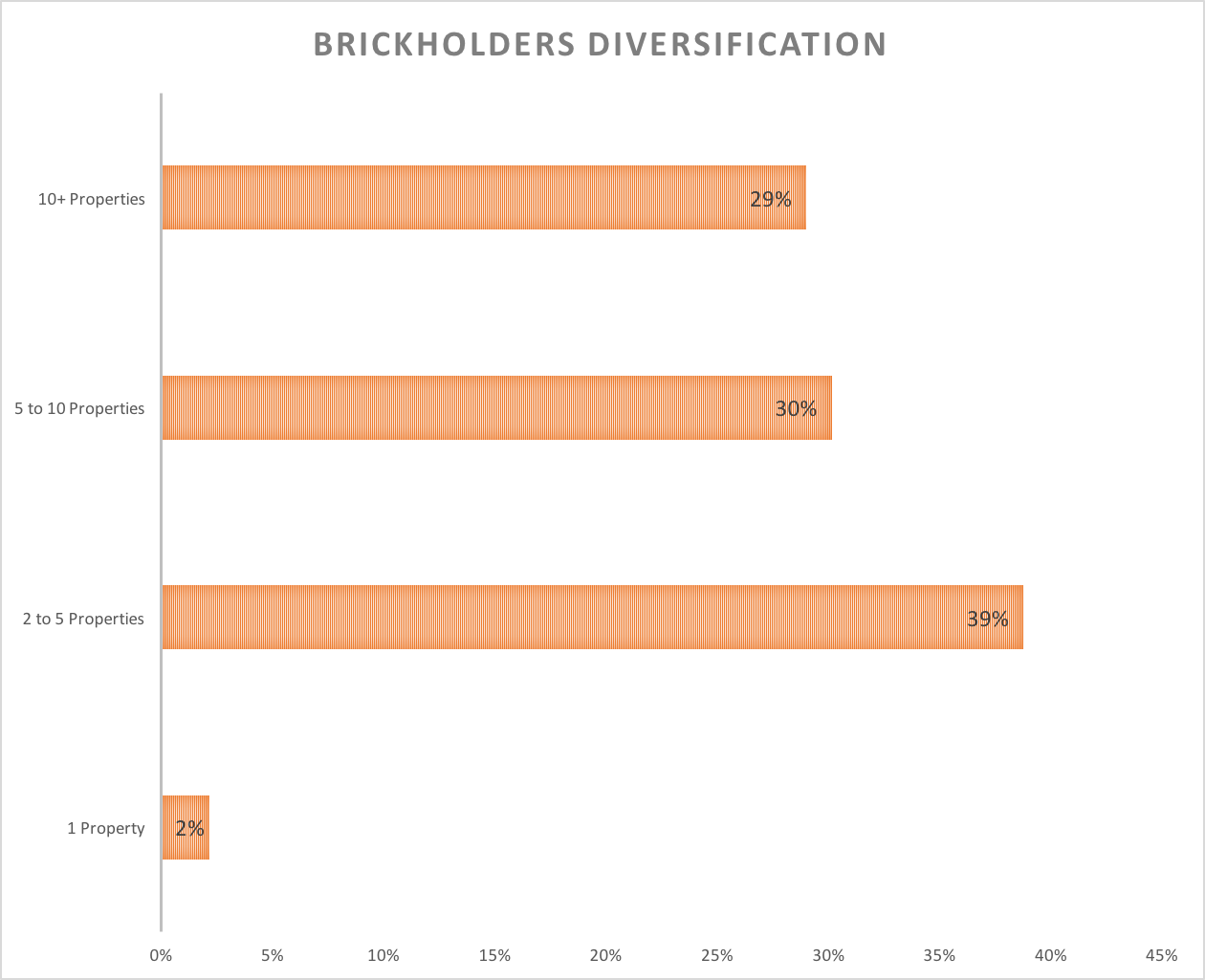

Diversification

We asked how many properties our investors see themselves investing in on BRICKX. 98% believe they will invest in 2 or more properties, with 59% planning on investing in either 5-9 or 10+ properties.

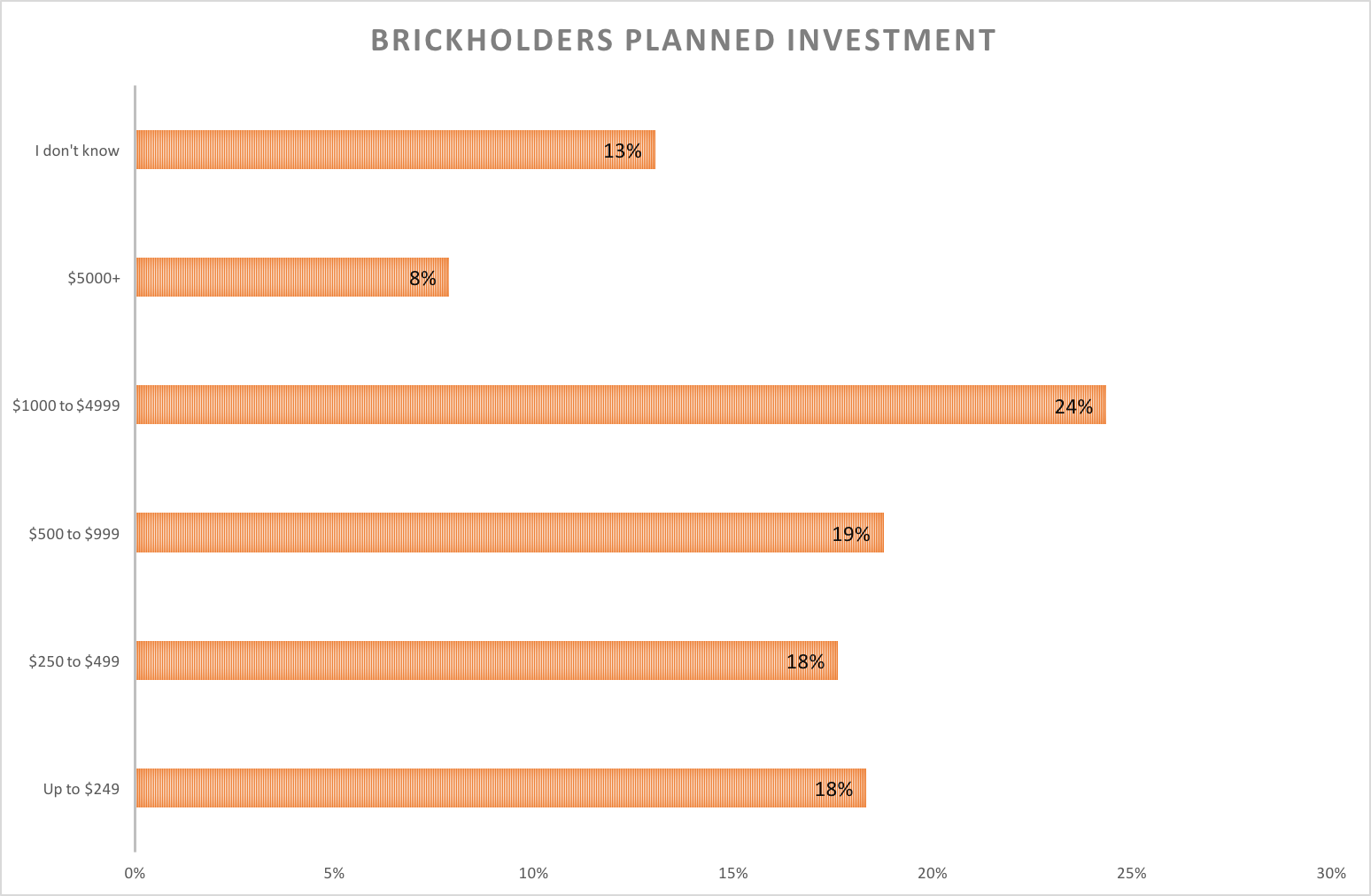

Average investment

We asked how much you planned to invest per property investment on BRICKX, and we love the fact that you are now able to take advantage of low accessible investment amounts to access residential property. We’ve got a great spread of respondents planning on investing up to $249 all the way to $5000+. Interestingly, the most frequent planned average investment per property is between $1,000 and $4,999.

How did you first hear of BRICKX?

Over 50% of our respondents heard about BRICKX through a friend, family member or social media. Property is always a hot topic, but the fact that we are part of everyday conversation and our investors are telling their friends to look at BRICKX is very humbling for us. The best way for us to grow our community (which is beneficial for all of us in improving demand and the speed at which we bring properties to BRICKX) is through advocacy – we thank our investors so very much, and long may this continue!

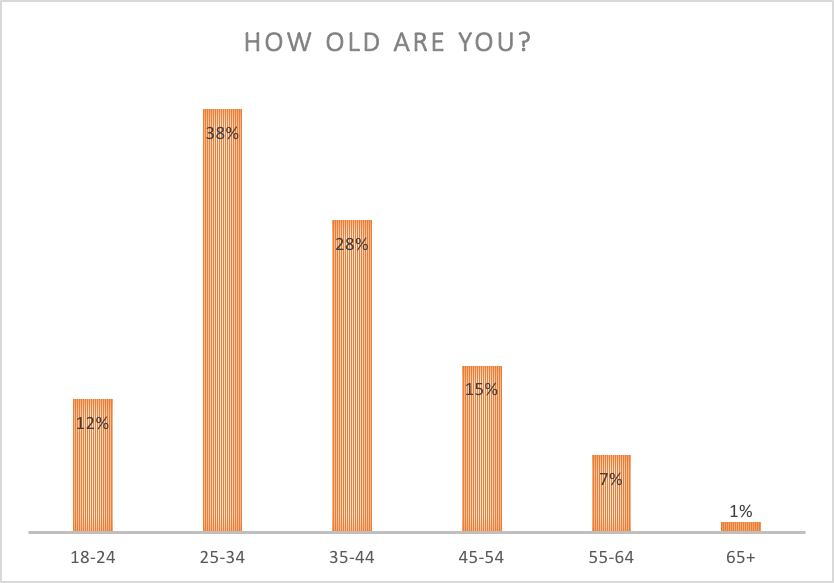

Who are our Brick Holders?

BRICKX has appeal across all age ranges, which is not surprising given the broad appetite for investing in residential real estate.

Millennials now able to access the residential property investment market

You’ll see from the graph, that over 50% of BRICKX investors who responded are under the age of 35 (Millennials). We also know from the question we asked around home ownership that 74% of these Millennial customers are using BRICKX to access the property investment market for the first time.

SMSF investors now able to diversify with BRICKX across their investment portfolio much more easily

The average age of our respondents with an SMSF is 44. For many who have an SMSF, getting investment exposure to residential property without buying the entire property has long been a challenge. Our customers have told us that the ability to diversify some of their SMSF into residential property investments, and across multiple properties on BRICKX has allowed them to now consider exposure to this asset class where they may not have been able to previously.

Reasons for using BRICKX: General investment, saving for a house deposit, saving on behalf of the kids for their future and SMSF

Not only are we providing access to residential property investment for the first time for many, but some Brick Holders are using BRICKX to track changes in the housing market whilst saving for a deposit. We absolutely see the logic in investing, through Bricks, in the type of asset you wish to own one day. Many Brick Holders are even investing on behalf of their children and grandchildren, citing that they are worried about how they will afford a deposit in the future. As mentioned previously our SMSF investors love the availability of the asset class, and ability to diversify their SMSF. The rest of our respondents are using BRICKX for general investment.

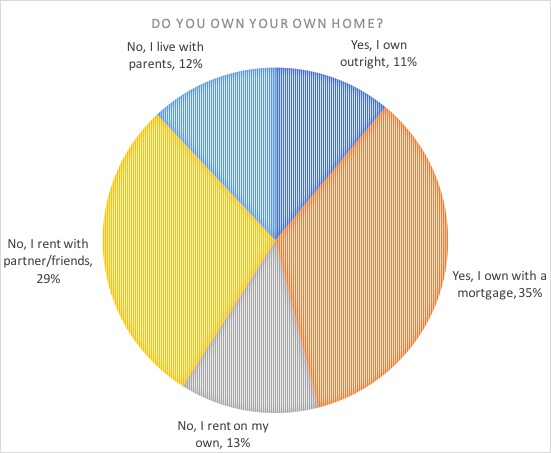

Home Ownership

46% of the survey respondents own their own home (either outright or with a mortgage). 42% are renting – it’s great to see those who don’t yet own any residential property getting investment exposure through BRICKX, and for those who do own, the ability to diversify and invest further.

What improvements could we make:

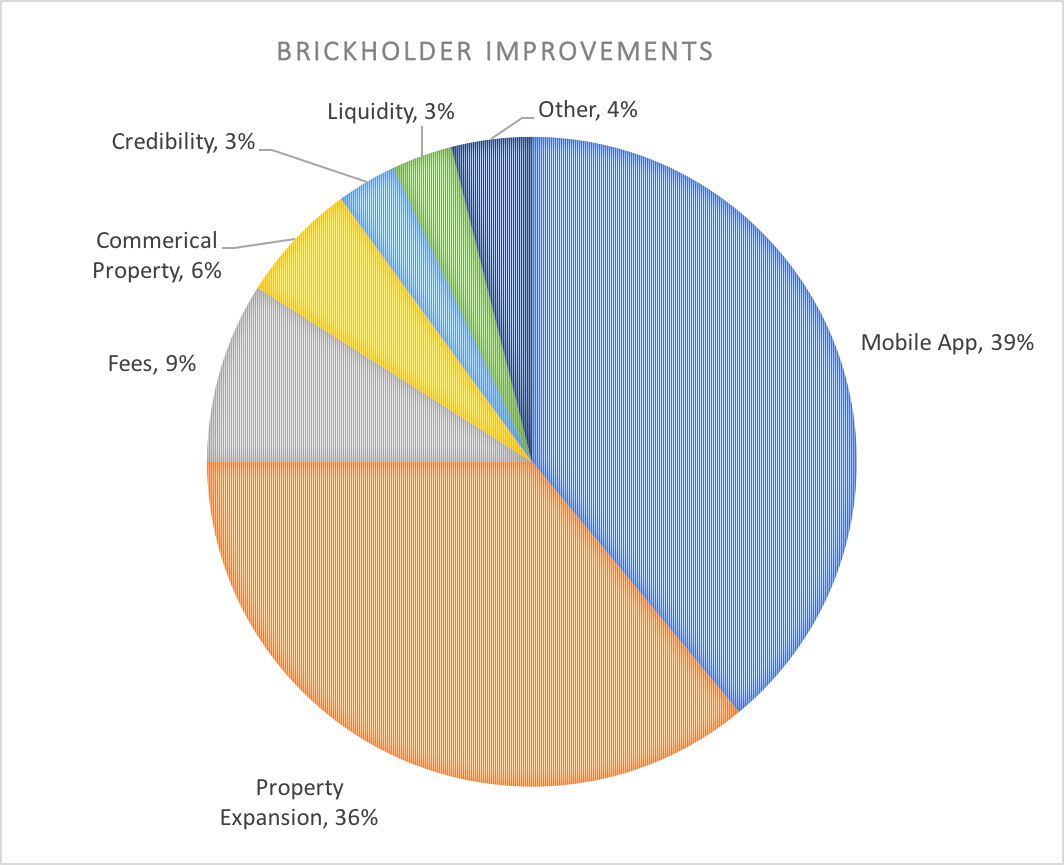

We openly asked Brick Holders, if they had any feedback or concerns which we could take on board to improve their experience. We categorised the answers and each are addressed below. We thank our respondents for these great, well thought out comments.

Mobile App – We’re hearing you on this one. We think this will be great, and the plans are in motion. We can’t give an indication of a date yet, but we’re on it! The functionality, such as to get notifications on low Brick prices, know when a new property is launching, or simply just quickly check your portfolio balances all spring to mind as great reasons for creating this.

Property Expansion and Diversification – We believe you all want more property options (new cities and different types of property). We continue to look for good opportunities and will be bringing more options to you very shortly. As our user base grows, we hope to speed up the rate at which we bring properties to BRICKX. We’re thrilled to have nearly 3,000 of you supporting the 7 properties on BRICKX already. You can read more about our current investment mandate here: http://blog.brickx.com/2016/12/18/buying-strategy/.

Fees – Our fee structure is very simple, a 1.75% fee for every transaction. 1.75% when you buy Bricks and 1.75% when you sell Bricks. Unlike many other funds, we don’t charge any funds under management fee, or performance fee, so if you hold your Brick for 1 year or 10 years, you’ll simply pay 1.75% of the transaction amount. Whilst the fee may seem high when compared to a traditional stockbroking account, what you are investing in here is a trust which holds an actual property – so it’s very different! When you think of the fees that exist when buying and selling an actual property and the time it takes, all those open houses and missed auctions –it certainly seems very reasonable. We also deduct a small percentage from the gross rent on a monthly basis prior to making distributions to Brick Holders to cover property management, annual audit and valuation fees.

Commercial Property – You would like us to expand into commercial property. This is certainly in the plan, and we hope there will be some options in late 2017 or early 2018.

Liquidity – Whilst only 3% of you were concerned about liquidity, our survey has shown that this is one of the biggest concerns that stops a new investor joining BRICKX – will they be able to sell their Bricks? The liquidity of Bricks really underpins the success of the Platform. Ahead of investing you want to know how easy it is to sell your Bricks. We’re pleased to tell you that the median time for Brick Holders to sell any Bricks they have put up for sale is 1.8 hours (monthly average measured from Oct 16 – Feb 17). This is much quicker than the time it usually takes to sell a property! Of course, to sell a Brick, a willing buyer needs to buy it from you. What we have found is that where sellers have priced their Bricks for sale around the level of the independent valuation, Bricks have tended to sell much quicker than when priced significantly above the independent valuation. The topic of liquidity is something that has come up frequently in the survey, and we have the product team now working on a solution which will more clearly demonstrate the ongoing median times to sell Bricks, and ensure you have a much more transparent view. Watch out for the release of the feature next week!

Credibility – Whilst only 3% of you are concerned about the credibility of the product, we think this is a topic worth addressing. When launching BRICKX we wanted to make sure we had a product that could be used by all Australians. This led us down the path of working with top lawyers and accountants to ensure we had a product structured for retail investors. The unique structuring of BRICKX sees each individual property investment held in separate Trusts, with an external trustee and separate Responsible Entity governing the Scheme. In the event that BRICKX was not to be a success, Brick Holders would still own their units in each Trust (their Bricks), and any deposits they had in their Digital Wallet are ring-fenced in a client Custodial account with ANZ. This structure allows you to invest knowing that the exposure you have is to the properties you may invest in, and not to BRICKX. A couple of interesting resources to look into are this blog: http://educationcentre.brickx.com/brickx-values-transparency/ and of course our PDS www.brickx.com/pds.

Thank you to everyone who participated in the survey. As a result of this, we’ll work to bring properties to BRICKX from locations that most appeal to our investors, fit with our investment mandate and the advice of the Property Team. We’ll also be launching a new feature to easily display how quickly Bricks are selling – and are working on a whole heap of other things to improve the BRICKX experience.

Anthony Millet, CEO

The opinions and beliefs expressed by the authors and forum participants as part of this communication do not necessarily reflect the opinions and beliefs of BrickX, BrickX Financial Services or other entities within the BrickX group.